In today’s fast-growing business world, accounting is more than ever the central pillar of a successful organization. In this dynamic context, the need to digitize and simplify accounting processes becomes obvious.

The adoption of an account management system is the best way to implement a comprehensive yet simple approach. It facilitates all aspects of billing managementfrom quotations to inventory management, sales, and reminders for overdue payments. Such a system offers a clear user interface and a rapid sales document editing process – with just one click, it’s now possible to edit or draw up quotations and invoice purchases with ease.

For SMEs or freelancers looking for a free, efficient solution, publishers like Furious offer a fully customizable option that blends ideally with any type of commercial service. With a dedicated CRM, customer relationship management becomes more fluid, enabling the generation of tailored, hassle-free sales documents such as sales documents or reminders.

Current legislation now requires every business document to comply with a certain standard, notably in terms of the general tax code and the possibility of including an electronic signature. These management systems thus provide a solid basis for up-to-date pre-accounting, with automated reminders and clearly established payment deadlines, giving an optimum overview of a company’s financial situation.

In this age of commercial digitization, choosing the right account management solution is synonymous with giving yourself the means to excel and focus on your core business, while being sure to comply with every aspect of legislation.

This is where the integration of an invoicing management tool comes into its own, enabling optimization of the accounting process, from simplifying invoice reconciliation to preparing VAT returns.

How does an invoicing tool facilitate your accounting processes?

Facilitate invoice reconciliation

One of the major challenges facing accountants is invoice reconciliation, a process which, if poorly managed, can lead to costly errors.

An automated invoicing management tool enables fast, accurate reconciliation by comparing invoices and purchase orders, avoiding errors and oversights.

Precise tracking of expenses

Having an accurate overview of your expenses is essential to making informed financial decisions.

Billing management tools provide you with a detailed breakdown of expenses, helping you to identify trends, plan the budget and make savings.

Efficient preparation of VAT returns

VAT is an essential element for any business.

Invoicing tools with pre-accounting functionalities greatly simplify the preparation of VAT returns by automatically categorizing and calculating the amounts due, thus avoiding reporting errors.

Automate and save time

Automating repetitive accounting tasks with an invoice management tool not only saves valuable time, but also minimizes errors, offering peace of mind and greater operational efficiency.

Integrate it with other tools!

Another great quality of a good billing management tool is its ability to integrate with other accounting and financial tools, creating a unified financial ecosystem for optimal management.

Current billing rules and obligations

What is billing management and its impact on your business?

Invoice management is a pillar of business management, covering the issuing, tracking and archiving of invoices. This process is crucial, as it has a direct impact on your cash flow and customer relations. Managing your invoices means :

- Maintain a healthy cash flow through regular payments and effective reminders.

- Prevent overdue receivables and strengthen your overall strategy for managing customer overdue receivables, a major issue for many companies.

- Maintain a relationship of trust with your customers through transparency and regularity.

- Guarantee legal compliance, thus avoiding potential sanctions.

Rules for compliant billing

Compliant invoicing respects a series of rules imposed by current regulations. Each invoice must :

- Include mandatory legal information such as SIREN number, issuer and recipient addresses, invoice number and issue date.

- Distinguish between the amount excluding VAT, the applicable VAT rate, and the amount including VAT.

- Be issued in duplicate (one for the sender, one for the recipient).

- Be kept for a legal period of 10 years.

The implications of the 2024 billing reform for businesses

The billing reform of 2024 will bring significant changes to business practices:

- Obligation for all companies to accept electronic invoices from July 1, 2024.

- Compulsory issue of invoices in electronic format for large companies, gradually followed by mid-sized companies, SMEs and micro-businesses.

- Invoices must be sent via approved dematerialization platforms.

The essential features of a modern billing tool

Invoicing software simplifies VAT returns

In the administrative jungle, a modern invoicing tool is your best ally. When it comes to VAT, here’s how it makes life easier:

- Automatic calculation of VAT for each invoice, without mathematical headaches.

- Generate periodic VAT summaries ready for your tax returns.

- Archiving and easy access to transaction history for stress-free auditing.

Automation to minimize accounting errors

Goodbye human errors! Automation is your bulwark against oversights and errors:

- Automatic recording of entries for up-to-date accounting.

- Synchronization with your bank for seamless reconciliation.

- Smart alerts to remind you of important deadlines and avoid late payments.

Modularity and integration at the heart of financial management

The importance of modular billing tools for growing companies

Your business is evolving, and so is your billing tool. It needs to grow with you:

- Additional modules to suit your needs: inventory, payments, project management...

- Adaptability to new markets or regulations: without disrupting your operations.

- Customizable features: add what you need, when you need it.

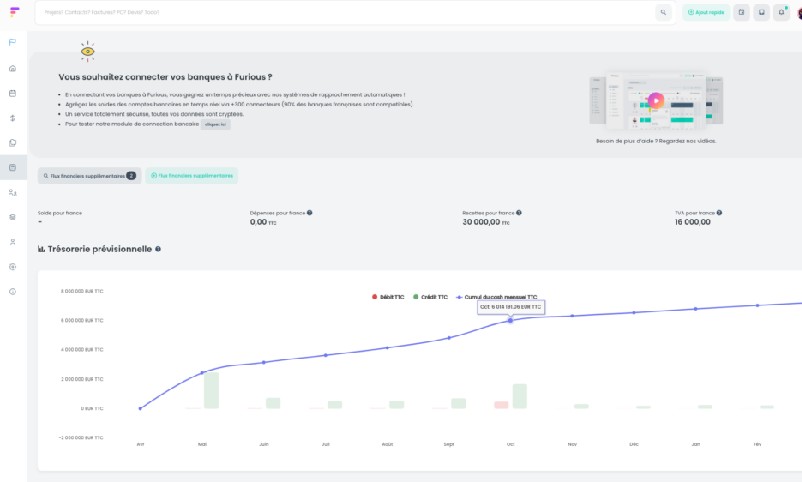

The benefits of Furious for pre-accounting

Furious is an all-in-one ERP software package at the heart of the digital transformation of pre-accounting.

Our software not only manages invoices efficiently, it also offers a robust suite of pre-accounting functions, from tracking expenses to preparing VAT returns.

Its modular architecture guarantees perfect adaptability to your company’s changing needs.

Integrating Furious Squad into your accounting ecosystem will not only be a strategic step forward, but also a sound investment in your company’s future.

Not to be underestimated, Furious is approved for the 2024 invoicing reform. So you can leave with peace of mind when you choose our software.

Explore further with Furious Squad

For integrated, optimized financial management, nothing beats the synergy of tools and their functionalities.

Find out how our billing and management tool fits into this vision.

If you’d like to broaden your understanding of our saas software, take a look at our articles dedicated to the world of invoicing & pre-accounting: quotation/invoicing software and invoicing tools.

Choosing the right billing solution: between free and professional

When should you consider a free billing management solution?

Just starting out or on a tight budget? A free invoicing solution could be a good place to start:

- For self-employed entrepreneurs or small businesses with limited invoicing volumes.

- When simplicity is preferred to a multitude of complex functions.

- When you're in the testing phase, to determine which features are essential to your business.

But beware: free doesn’t always mean effective in the long term.

The benefits of professional invoicing software for your business

Switching to professional invoicing software means choosing to invest in the future and growth of your business:

- Increased reliability: compliance with the latest accounting and tax regulations.

- Time savings: considerable thanks to automation of repetitive processes.

- Enhanced data security: for maximum peace of mind.

- Technical support and regular updates: to keep pace with the evolution of your business.

The transition from a free system to a paid tool is a step towards greater professionalism and efficiency. It’s a strategic choice for any company wishing to grow serenely.