Many of our users relied on Excel, or even Word or InDesign for the more adventurous, before discovering Furious to create their quotes and invoices.

However, beyond the aesthetic limitations and the time spent on these tasks, the choice not to use dedicated invoicing software proves to be a real mistake in the daily management of your business.

Indeed, an invoice issued without the use of approved software (whether single-task or ERP like Furious) can be legally challenged. Furthermore, integrating an invoicing tool into your management system offers multiple advantages, and that is precisely what we will detail for you.

To begin with, invoicing software allows you to have better reporting and accurate VAT tracking. You are assured that all legal and mandatory information is present on your documents, in accordance with the requirements of the General Directorate of Public Finance (DGFIP). This is even more important if you are a VAT-registered company or if you conduct operations with the public sector.

Software like Furious ensures that each invoice issued complies with current standards, by clearly displaying essential information such as the SIREN number, the sender’s and recipient’s addresses, as well as details related to delivery or service provision.

When an invoice is issued, it must be transmitted via a dematerialization platform approved by the DGFIP, thus ensuring secure transmission of transaction data. In 2023, the postponement of the effective date for mandatory electronic invoicing between businesses was confirmed, which means that all businesses concerned by invoicing must be ready to issue their invoices in a structured format compliant with DGFIP requirements.

In summary, the use of invoicing software is now a crucial element in the administrative management of your business. It guarantees the compliance of your documents, facilitates the transmission of essential data to the DGFIP, and saves you valuable time (automation of quotes and invoices). Do not underestimate the importance of this step and make sure to choose the best solution for your business, in order to be perfectly ready for the entry into force of widespread electronic invoicing.

*April 2024: our software, Furious, has just received the renewal of NF203 certification for the year 2024/2025 with the jury’s congratulations – a guarantee for our clients of compliance with the new standards for electronic invoicing. We are certified software!

What is e-invoicing and why has it become essential?

Electronic invoicing is the sending and receiving of invoices in a digital format, allowing for faster, more secure, and eco-responsible processing. It has gained a prominent place in the business world, particularly with legislative developments that make it mandatory in many cases.

- Modernity and efficiency: in an era where everything is accelerating, electronic invoicing helps avoid wasting time with postal mailings and the risks of errors related to manual entry.

- Enhanced security: electronic invoices are often more secure than their paper counterparts, with encryption and electronic signature systems.

- Simplified archiving: no more dusty binders! Your invoices are stored digitally, making them easier to find and access when needed.

- Eco-responsibility: by choosing electronic invoicing, you contribute to reducing paper usage and decreasing your carbon footprint.

The advantages of e-invoicing for businesses

Adopting electronic invoicing represents a lever for growth and security for businesses, regardless of their sector of activity.

- Cost reduction: less paper, fewer postal mailings, fewer errors... Electronic invoicing allows for substantial savings.

- Improved cash flow: payments are often faster with electronic invoices, thus improving the company's cash flow.

- Ensured compliance: with the growing obligation to switch to electronic invoicing, its adoption ensures your compliance with the latest regulations.

- Optimized supplier and customer relationships: the clarity and speed of electronic transactions help strengthen trust between you, your suppliers, and your customers.

Thus, integrating electronic invoicing into your processes is not only a legal obligation, it is also an opportunity to optimize your management and strengthen the security and efficiency of your commercial transactions.

The Obligation to Digitize Invoices: An Added Benefit

The French State, through the Finance Laws of 2020 and 2021, aims to accelerate its plan for modernizing the economic life of businesses (or e-invoicing) and the transmission of data to the tax administration (or e-reporting). For example, some countries like Italy are more advanced than us on the subject.

The obligation for invoice digitalization will therefore be effective from July 1, 2024, in all B2B exchanges.

Why?

- Reduce processing costs

The cost of invoice processing is significant, and the difference between the paper version (estimated at 10 euros) vs. the dematerialized version (estimated at 1 euro) speaks for itself.

- Streamline and make exchanges more reliable / shorten payment terms

It is also clear that it is easier to ensure proper receipt of invoices, simplify exchanges between suppliers and customers, and accelerate the entire process by moving to dematerialization. But this implies that all stakeholders must be able to issue and receive electronic invoices.

- Strengthen the fight against VAT fraud, but also pre-fill your VAT declarations. In short, better traceability.

- Strengthen the competitiveness of French businesses

Is e-invoicing mandatory in France and who is affected?

Since the announcement of the Finance Laws of 2020 and 2021, the French State has clearly expressed its desire to accelerate the digitalization of commercial transactions and data exchanges with the tax administration. But then, has electronic invoicing become mandatory for all businesses?

- Mandatory for all B2B exchanges: from July 1, 2024, electronic invoicing will be mandatory for all business-to-business (B2B) exchanges.

- Who's concerned? : All businesses, regardless of their size and sector of activity, will be affected by this obligation. This includes SMEs, large companies, and also self-employed individuals.

The impact of mandatory e-invoicing on SMEs and large businesses

The obligation to switch to electronic invoicing will have a significant impact on how businesses operate, especially on SMEs that have not yet taken the digital leap.

For SMEs:

- Investment in adapted tools: SMEs will need to invest in electronic invoicing solutions to be compliant.

- Team training: it will be necessary to train employees in the use of these new tools.

- Optimization of internal processes: this is an opportunity to review and optimize internal invoicing-related processes.

For large businesses:

- Adaptation of existing systems: large companies, often already equipped, will need to adapt their systems to comply with the new requirements.

- Enhanced security: the digitalization of invoices requires a high level of security to protect sensitive data.

Key implementation dates for mandatory e-invoicing

The implementation of mandatory electronic invoicing will be gradual, with key dates not to be missed.

- July 1, 2024: obligation for all businesses to accept electronic invoices.

- July 1, 2024 - June 30, 2025: large businesses will have to issue all their invoices in electronic format.

- July 1, 2025 - June 30, 2026: mid-sized businesses will in turn be required to issue all their invoices in electronic format.

- From July 1, 2026: this obligation will extend to SMEs and micro-businesses.

However, these are the initially planned dates. The implementation has been postponed and will be decided during the 2024 Finance Law.

In summary, the transition to electronic invoicing is not only a legal obligation, but it also represents an opportunity for businesses to modernize their practices, gain efficiency, and strengthen the security of their commercial exchanges. It is therefore crucial for every business to prepare and adapt to these changes to remain competitive and compliant with legislation.

What are the deadlines for compliance?

Laurent Chetcuti, KPMG partner lawyer, shared his expertise with dafMag.fr:

“As of July 1, 2024, all businesses must be able to receive an electronic invoice. On the same date, large businesses will be obligated to issue electronic invoices. This obligation will be effective from January 1, 2025 for mid-sized businesses and January 1, 2026 for SMEs and micro-businesses. This refers to the legal structure of the company, not the group.”

Two choices will be available to you at that time:

- submit your invoices to accredited platforms

- or submit them directly to the public invoicing portal, as Italian companies, for example, already do.

What should my invoices look like?

As you can see, the State, and more broadly, the European Union, wishes through this directive to standardize and structure invoices, in order to strengthen the consistency, security, and quality of the data thus continuously transmitted to the tax administration.

Invoices issued and received must strictly adhere to a specific format and precise data in order to be processed automatically.

So, goodbye to non-standardized paper and PDF formats!

You will also need to communicate to the tax administration your data from:

- your sales made with foreign businesses and/or with individuals (French and foreign)

- your purchases made from foreign companies.

- payment of certain invoices issued, as well as their status.

What are the standards and formats to be respected for electronic invoices?

To comply with the new legislation and ensure a smooth transition to electronic invoicing, it is essential to understand the standards and formats that your invoices must adhere to.

- UBL Format (Universal Business Language): it is a standardized format for electronic commercial documents, recommended by the European Union.

- Factur-X: it is a Franco-German standard that allows integrating electronic invoice data into a PDF file, thus facilitating human and machine readability.

Why these formats?

- Interoperability: these standards allow for better communication and data exchange between the different IT systems used by businesses and the tax administration.

- Processing automation: thanks to these formats, it is possible to automatically process invoices, thus reducing errors and accelerating processing times.

Data to be communicated:

- Sales with foreign businesses and individuals: you must transmit data related to these transactions.

- Purchases from foreign companies: this information must also be communicated.

- Payment of certain invoices: it is necessary to transmit payment information and the status of invoices.

In summary, adopting the right formats and standards for your electronic invoices is not just a matter of compliance; it is also a way to simplify and accelerate your invoicing processes, while reducing the risk of errors. This represents a crucial step to ensure that your business is ready and equipped to meet the requirements of mandatory electronic invoicing.

What are the risks if I am not compliant?

It is clear that electronic invoicing is an effective weapon to combat extended payment delays, improve your working capital, and thus avoid bankruptcy. Today, nearly 420 billion euros in financial debt are estimated in France!

Those who are not compliant will be penalized: ” For non-compliance with e-invoicing, they risk a fine of 15 euros per invoice, limited to 15,000 euros per year. For non-compliance with e-reporting, the fine is 250 euros per transmission, also limited to 15,000 euros per calendar year. But the main penalty is indirectly related to cash flow. If a company does not transmit an electronic invoice, it simply will not get paid ” Laurent Chetcuti further states.

How do I prepare for it?

“No wind is favorable to him who does not know where to go”

Re-evaluate your tools and anticipate the choice of your partner. By the way, take a look at this TOP 10 pitfalls to avoid when migrating an ERP. 😉

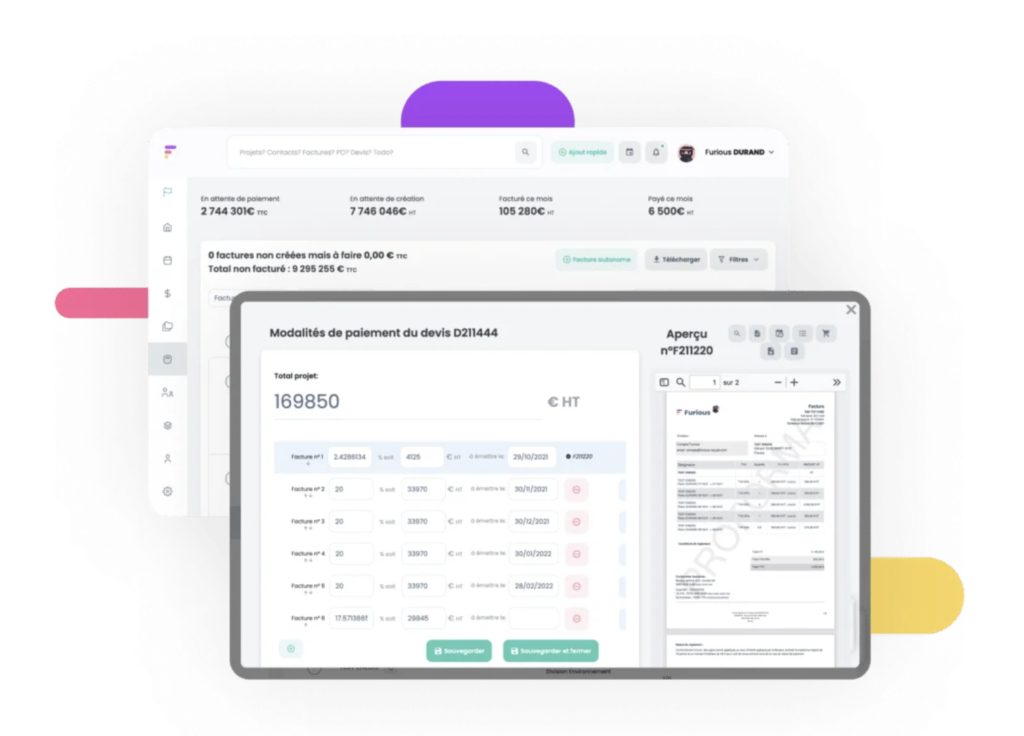

Furious automatically detects invoices to be issued, ensures bank reconciliation, forecasts your cash flow for 12 months, communicates autonomously with your teams, and saves you time. And most importantly, it allows you to be compliant with upcoming regulations.

Furious is also, and above all, certified software for electronic invoicing (NF203 certification)

What are the steps to implement electronic invoicing in your business?

Implementing e-invoicing requires organization and precision. Here are the key steps to follow:

- Assess existing needs and resources: analyze the tools and systems you currently use for invoicing.

- Research and choose an e-invoicing solution: select software tailored to your company's size and specific needs.

- Team training: ensure your employees are trained and comfortable with the new system.

- System testing: before fully transitioning to e-invoicing, perform tests to ensure everything works correctly.

- Implementation: once everything is ready and tested, implement e-invoicing throughout the company.

- Monitoring and adjustments: monitor the process and make necessary adjustments to ensure a smooth transition.

E-invoicing Platform: How to Choose the Right Solution?

The market offers a multitude of e-invoicing solutions, and it’s crucial to choose the one that best suits your company.

- Ease of use: opt for an intuitive and user-friendly solution.

- Compliance with legislation: ensure the solution complies with current norms and standards.

- Integration with your other tools: the solution must integrate easily with the other software you use.

- Support and assistance: check the quality of customer support offered by the provider.

In short, every change is an opportunity, and this reform gives you one more reason to adopt an ERP.

Contact us for a quick demo that can change your life!