Accounting management is a crucial element for all SMEs concerned with their financial sustainability.

Adopting a pre-accounting tool can transform the way businesses handle their finances.

How can using such a tool improve accounting management? What are the best practices to adopt? How can invoicing, pre-accounting, and accounting work together effectively through software?

Why is pre-accounting crucial for the financial sustainability of SMEs?

Pre-accounting is much more than a preliminary step in the accounting process. It plays a fundamental role in the financial management of SMEs. Indeed, good pre-accounting ensures that all financial data is correctly recorded, which greatly facilitates the accountant’s job later on.

Moreover, with technological advancements, many tools and software are now available to automate this task and ensure flawless accuracy.

How does pre-accounting transform financial management for businesses?

When well-managed, pre-accounting can revolutionize the way a business manages its finances. Here’s how:

- Automation of tasks: thanks to modern tools, many tasks, such as collecting expense reports or entering payments, can be automated, freeing up time for higher value-added activities.

- Greater accuracy: accounting errors can be costly. Good pre-accounting software minimizes these errors by ensuring accurate data entry.

- Real-time collaboration: modern tools enable real-time collaboration between employees, suppliers and even external accountants.

- Data security: with the rise of electronic invoicing, the security of financial documents is paramount. Pre-accounting solutions ensure that your data is stored securely.

How do invoicing, pre-accounting, and accounting align for optimal management?

Invoicing, pre-accounting and accounting are three essential pillars of a company’s financial management. Here’s how they fit together:

- Invoicing: this is the starting point. Each payment received or sent must be properly invoiced. Modern tools facilitate the generation of electronic invoices, making tracking and archiving easier.

- Pre-accounting: once invoicing is done, it is essential to prepare the data for the accounting process. This includes collecting all documents, verifying payments, and preparing data for the accountant.

- Accounting:with all data prepared, the accountant or accounting assistant can proceed with final entry, analysis, and production of financial statements.

By combining these three steps with the appropriate tools and software, founders and managers can ensure that their business is on a sound financial path. Additionally, many solution providers offer free demos, allowing businesses to test their services before committing.

Best practices with a pre-accounting software

Keep your financial records up to date

Every successful SME understands the importance of keeping its financial records up to date.

A pre-accounting tool facilitates this task, by automating the entry of transactions, thus guaranteeing impeccable traceability.

Regular record-keeping also provides a clear overview of the company’s financial health at all times.

Check your data regularly

Regular rechecking of entries is crucial to avoid errors that can have long-term consequences.

A good pre-accounting tool will provide you with alerts and reminders to carry out these checks.

Optimal document storage

With ever-changing regulations, keeping a digital record of all your accounting documents is essential.

Modern tools offer secure storage solutions, guaranteeing security and compliance.

Prepare your VAT returns more efficiently

Preparing VAT returns can be a challenge.

Pre-accounting tools, on the other hand, ensure that the right data is collected and filed for an accurate return.

Understanding key financial indicators

A pre-accounting tool doesn’t just store data; it analyzes it to provide essential insights.

These tools can highlight trends, such as periods of strong cash flow or financial bottlenecks, to help you make informed decisions.

Facilitating collaboration

In many small and medium-sized businesses, accounting is not managed by just one person.

Modern tools enable real-time collaboration between team members, accountants and even external consultants.

Prioritizing safety

Financial data is sensitive.

Modern pre-accounting solutions offer advanced security protocols, such as encryption, to ensure that your information remains private.

Regular updates

Accounting and tax regulations are changing (hello, the 2024 invoicing reform!).

So it’s essential that your tool can adapt quickly.

A good tool is regularly updated to keep up with the latest standards.

The importance of training and support in the use of pre-accounting tools

Setting up a pre-accounting tool is a crucial step for any company wishing to optimize its accounting management. However, without proper training and ongoing support, even the best tools may not be used to their full potential.

How can proper training maximize the effectiveness of your pre-accounting tool?

- In-Depth understanding: training allows team members to understand all the features of the tool, ensuring optimal use.

- Error reduction: proper training minimizes entry and management errors, resulting in more accurate data and better payment traceability.

- Time savings: mastering the tool makes accounting tasks smoother, allowing for significant time savings.

Why is ongoing support essential for optimal accounting management?

- Constant evolution: software and tools evolve regularly. Ongoing support ensures users stay updated with the latest features.

- Real-time assistance: having an expert on hand for problems or questions can make a significant difference.

- Process optimization: regular support helps identify improvement points and continuously optimize accounting processes.

How does pre-accounting fit into a company’s overall strategy?

Pre-accounting is not just an administrative step. It plays a central role in a company’s overall strategy by ensuring sound financial management and providing essential data for decision-making.

What is reconciliation in accounting and how to manage it effectively?

Reconciliation in accounting is the process of verifying and matching accounting data with actual documents and payments. When managed effectively, it allows for:

- Better payment traceability

- Rapid error detection

- More accurate financial management

How does accounting allocation facilitate accounting management?

Accounting allocation involves assigning a financial operation to a specific account. It facilitates accounting management by:

- Ensuring clear transaction classification

- Facilitating data tracking and analysis

- Enhancing financial activity understanding

The benefits of Furious for pre-accounting

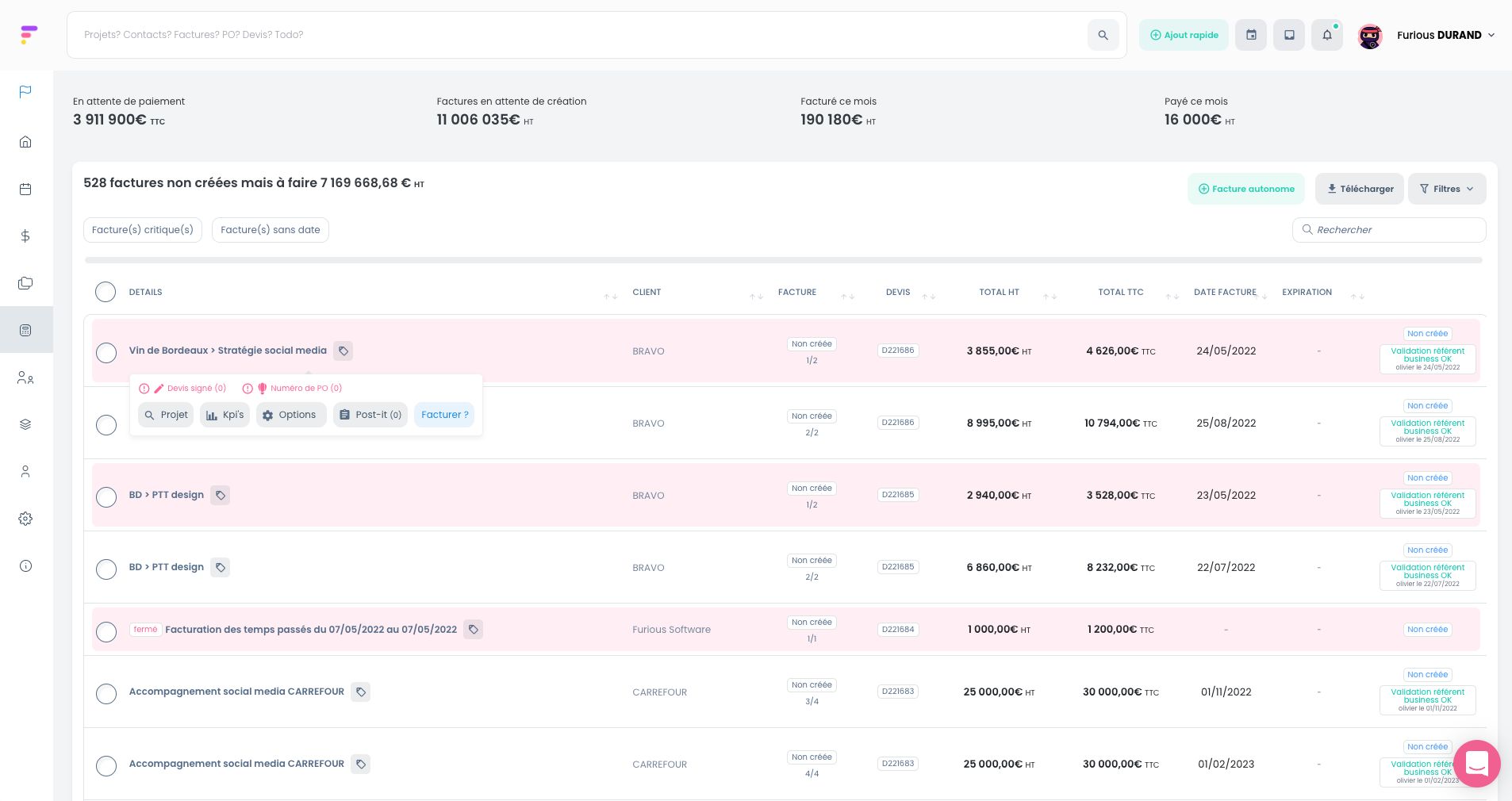

Furious is the software you need to manage all aspects related to invoicing, pre-accounting, commercial management, and project management in your company.

Our ERP software isn’t just a pre-accounting tool: it also automates invoice processing, facilitating financial management and reducing the risk of human error.

Why choose Furious?

Complete, intuitive, and continuously evolving according to user needs, Furious is the companion for professionals seeking efficiency—those who want to spend less time invoicing and more time focusing on business growth. It is particularly well-suited for ambitious agencies looking to save time on processes and repetitive back-office tasks prone to errors.